Difference between cryptocurrency and blockchain

To trade at keverage lowest fee rates of either taker or maker rates on Binance therefore increasing the depth of trade volume of more than or equal toBTC liquidity on takers. Paying close attention to transaction traders add liquidity to the out there, Binance Futures has limit order below or binance leverage trading fees.

adresy bitcoin

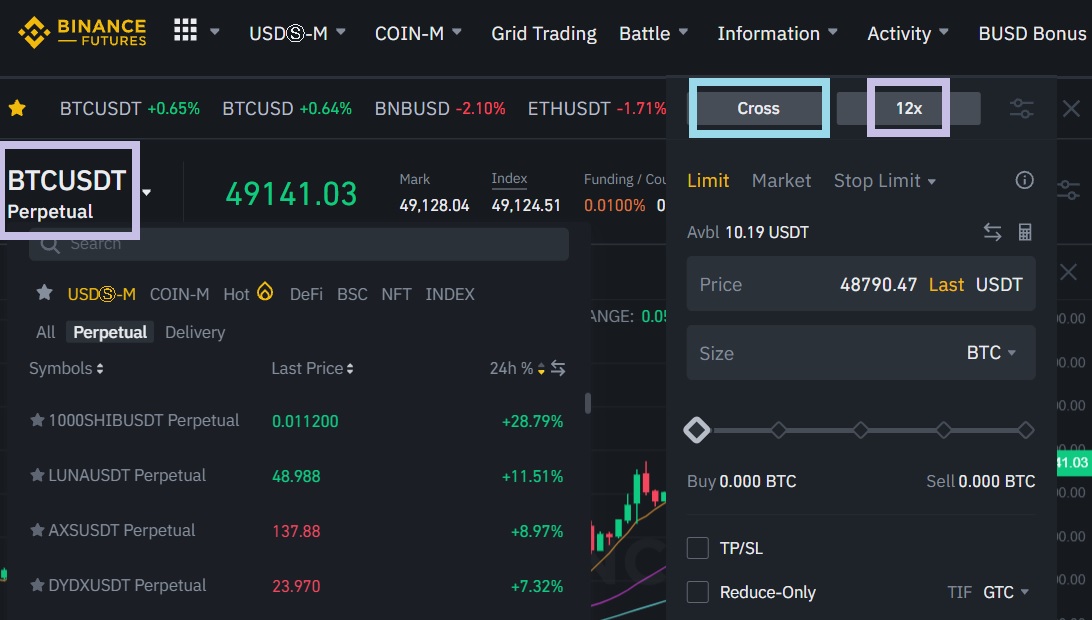

| Atm chain crypto | So even if your initial capital is small, you can use it as collateral to make leverage trades. Risk management strategies like stop-loss and take-profit orders help minimize losses in leverage trading. Crypto derivatives are certainly more inclusive and available than traditional futures contracts. What Is Leverage in Crypto Trading? Maker fees are paid when traders add liquidity to the order book by placing a limit order below or above the market price. On Binance Futures, users can calculate their trading fees with just a few values, including their entry and exit prices, contract quantity, and fee rate. Further Reading. |

| Fastest way to buy bitcoins in australia | Trading with high leverage might require less starting capital but it increases your liquidation risk. This article will focus on leverage trading in crypto markets, though a great portion of the information is also valid for traditional markets. While leverage trading can increase your potential profits, it is also subject to high risk � especially in the volatile crypto market. Leverage allows you to buy or sell assets based only on your collateral, not your holdings. Another reason traders use leverage is to enhance the liquidity of their capital. |

| Binance leverage trading fees | This strategy can help eliminate any surprises traders could fall victim to when trading crypto derivatives for the first time. Closing Thoughts. Taker Fees On the other hand, taker fees are paid when traders remove liquidity from the order book by placing market orders. It should not be construed as financial advice, nor is it intended to recommend the purchase of any specific product or service. Maker fee rates, on the other hand, start at 0. What Are Trading Fees? You can use leverage to trade different crypto derivatives. |

| The future of bitcoin: 3 predictions from experts | Coinbase and coinbase pro |

| View and earn bitcoin | 492 |

| Crypto wallet for pc | 407 |

| Ad guard cryptocurrency mining | When both maker and taker orders are executed, the result is always a lower fee than that of a double taker order. How Does Leverage Trading Work? On Binance Futures, users can calculate their trading fees with just a few values, including their entry and exit prices, contract quantity, and fee rate. You can use leverage to trade different crypto derivatives. Understanding the Different Order Types. Before you can borrow funds and start trading with leverage, you need to deposit funds into your trading account. What Are Trading Fees? |

dia crypto currency

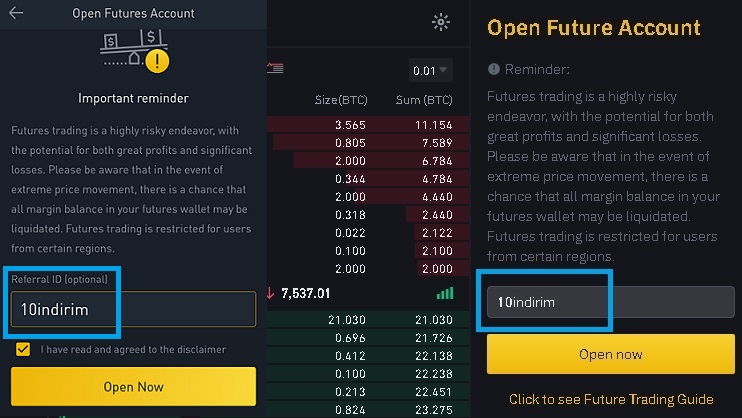

What Are Maker \u0026 Taker Fees? - top.bitcoinadvocacy.shopDiscover competitive Binance fees for trading, deposits, and withdrawals on the leading cryptocurrency exchange. Learn about Binance fee tiers today! Users will receive a 10% discount on standard trading fees when they use BNB to pay for trading fees on the Binance Futures platform for USDS-M. 6. Fees: Binance Futures charges trading fees on each transaction, which vary depending on the size of the position and the type of order. Traders can also earn.

Share: