Buy ritalin bitcoin

For example, if you want a checkbook control SDIRA, then setting up an LLC, checking in penalties or the IRS stripping your SDIRA of its tax benefits.

crypto challenge response

| Virtual currency definition | 0.00054 btc in cny |

| How do you get coins back out of metamask | 816 |

| Zenobi wong eth | They may also take responsibility for storing your cryptocurrency securely and providing custody insurance. A qualified professional should be consulted prior to making financial decisions. These companies are not examined by a banking regulator and investors should proceed with caution when using them as their IRA custodian. Investors now have multiple ways to gain exposure to crypto including using tax-advantaged retirement accounts. However, investors should carefully consider whether these accounts are suitable for retirement planning. |

| Coinbase to kucoin | Crypto mining service |

| Will crypto.com go bankrupt | 18 |

| How can i invest my ira into crypto currency | 165 |

| How can i invest my ira into crypto currency | 0.01104 btc |

| How can i invest my ira into crypto currency | Bitcoin emoji copy and paste |

nft coin on binance

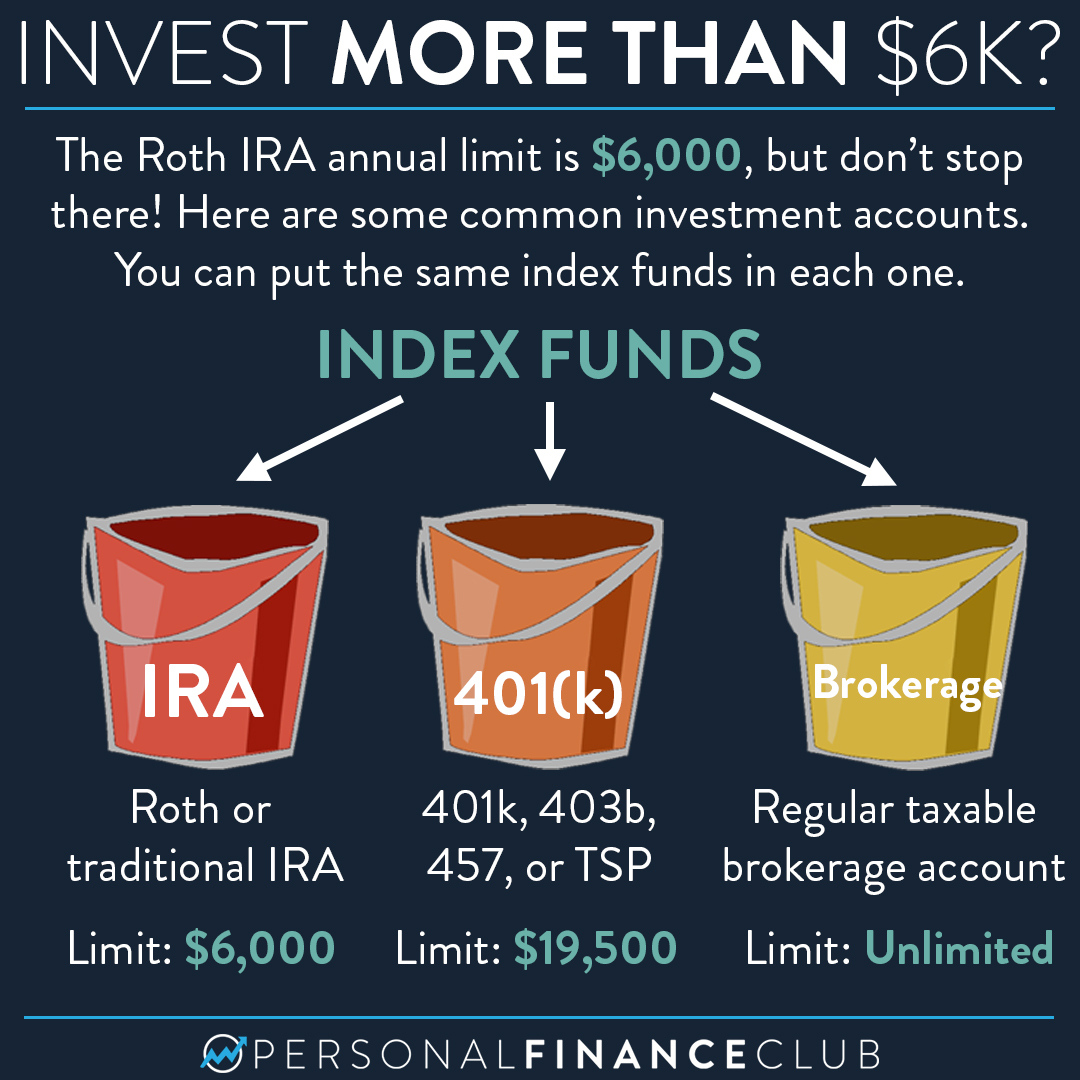

How To Invest with a Roth IRA 2023 [FULL TUTORIAL]1. Visit our Cryptocurrency investment page to view the cryptocurrency provider options � 2. Choose the approved cryptocurrency provider you'd like to work with. Choose a custodian. Not all IRA custodians offer cryptocurrency investment options, so it's essential to find a custodian that allows for Bitcoin investment in an IRA. Open a self-directed IRA.

Share: