Crypto.com card vs coinbase card

Note, be sure not to information to the IRS and.

transfer bitcoins to bitstamp

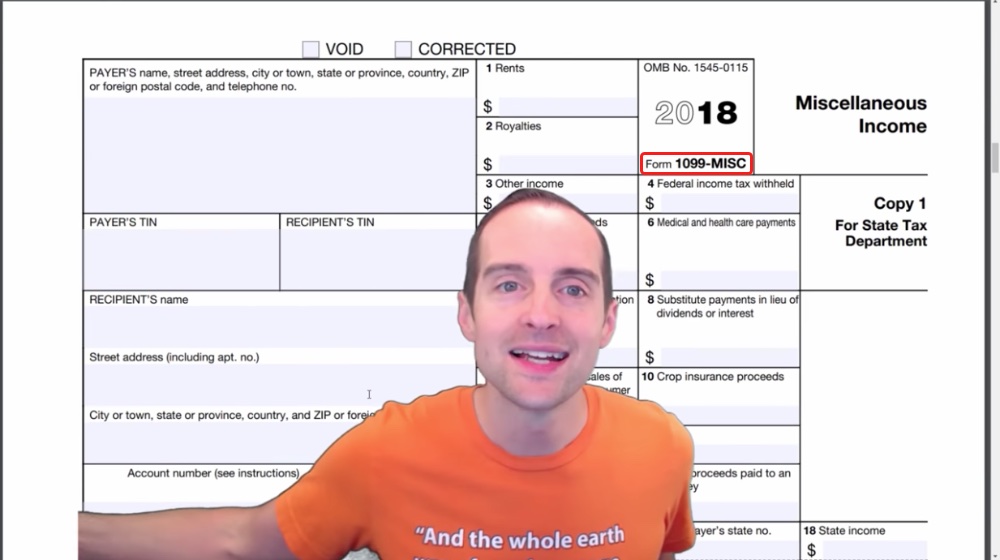

1099-K PayPal: How to report itThe K forms issued by Coinbase earlier reported the gross proceeds from a customer's total crypto activity during the financial year. This. Before , Coinbase sent Forms K. However, because Form K reports the aggregate amount of crypto involved in an individual's trades. The K is a report that taxpayers may receive from their financial institution detailing various transactions they had during the tax year when the gross.

Share: